The Board of Directors of Harris County Municipal Utility District No. 504 (HCMUD 504) wants to ensure residents have a clear understanding of the property tax exemptions available and how property taxes are calculated each year.

For the 2025 tax year, the Board continues to offer an exemption for residents who are age 65 or older and/or disabled. This exemption reduces the assessed value of a home by $20,000, helping qualifying residents manage rising property values and maintain affordability.

The District reviews all exemptions each spring and votes on whether to maintain or adjust them. These exemptions also factor into the District’s tax rate, which is set each fall.

How Your Property Taxes Are Calculated

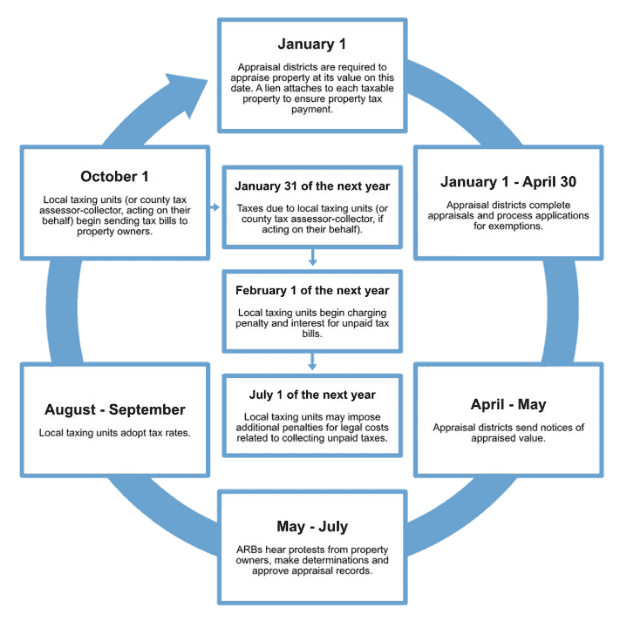

Your property tax is based on your home’s appraised value as of January 1st of each year, as determined by the Harris Central Appraisal District. You may protest your appraisal with the Appraisal District if you believe your property has been overvalued.

- Market Value: The estimated price your home could sell for in the current real estate market.

- Appraised Value: The official assessed value determined by the appraisal district.

Once appraisal values are certified, the HCMUD 504 Board sets the District’s tax rate with guidance from its financial advisor. Your tax bill is calculated by multiplying your home’s appraised value—after any exemptions—by the tax rate.

Tax bills are typically mailed by late October or early November, and payment is due by January 31 of the following year to avoid incurring a penalty.

HCMUD 504 Tax Rate for 2025

HCMUD 504’s tax rate is made up of two parts:

- Maintenance and Operations (M&O) Tax: Funds the District’s day-to-day operations, including parks, street lighting, and administration.

- Debt Service Tax: Pays off bonds issued to fund infrastructure projects such as water, sewer, and drainage improvements and road facilities.

The total tax rate is the sum of the M&O and debt service taxes. For the 2025 tax year, the Board voted to set the rate at $1.05, which is the same as last year. This tax rate helps balance funding for essential services while keeping tax bills manageable.

For more detailed tax information, visit the District’s Tax Information page.

Key Points for Residents

- Property appraisals are conducted every January 1.

- You may protest your appraisal if it seems inaccurate.

- Local entities, including HCMUD 504, set their own tax rates each fall.

- The 2025 over-65/disabled exemption remains $20,000.

- Property taxes are due by January 31 to avoid late fees.

Calculating Your Tax Bill

(Appraised Value – Exemptions) ÷ 100 × Tax Rate = Your Property Tax Bill

For a step-by-step example, watch the informational video produced by the Association of Water Board Directors (AWBD).

.jpg)